The past financial year saw a roller coaster ride for investors. Share markets plunged into Christmas only to rebound over the last six months. This note reviews the last financial year and takes a look at the investment outlook for 2019-20.

A volatile but good year for diversified investors

The past financial year saw pretty good returns for investors. But it didn’t feel so good around Christmas as a combination of worries – President Trump’s trade war with China, a slowdown in China, Fed rate hikes, an end to quantitative easing in the Eurozone, falling property prices and election fears in Australia saw share markets fall sharply. In fact, from its September high to Christmas Eve US shares plunged 20%. But in the last six months share markets have rebounded as while the trade threat has run hot and cold and tensions in the Middle East have escalated central banks have turned dovish with many either easing (like the RBA and PBOC) or signalling that monetary easing is likely (such as the Fed and ECB). This has seen global share markets rebound sharply with Australian shares having their best June half since the early 1990s – helped along by the return of the Coalition Government.

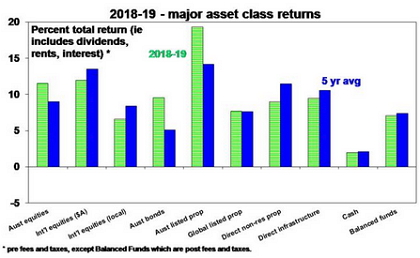

So for the financial year as a whole global shares returned 6.6% in local currency terms and thanks to a fall in the Australian dollar they returned 12% in Australian dollar terms. Australian shares returned 11.6% touching an 11-year high.

Cash and bank deposits had poor returns not helped by the RBA cutting the cash rate to a new record low in June. But bonds had a spectacular turnaround as rising bond yields on the back of Fed tightening a year ago gave way to plunging yields – to record lows in many countries – as inflation subsided and central banks turned dovish resulting in Australian bonds returning 9.6%. The plunge in bond yields reinvigorated the search for yield and so helped yield-sensitive listed property and infrastructure have strong returns. Unlisted property and infrastructure continued to do well, despite a rougher ride for retail property. Balanced growth superannuation funds are estimated to have returned around 7% after taxes and fees. For the last five years their returns have averaged around 7.4% pa, which is not bad given sub 2% inflation.

Source: Thomson Reuters, AMP Capital

Australian residential property fared poorly though with average capital city prices down 8%, but signs of stabilisation have emerged recently helped by the election result and rate cuts.

Key lessons for investors from the last financial year

These include:

-

Turn down the noise – despite the endless predictions of financial disaster it turned out okay again.

-

Maintain a well-diversified portfolio – while shares had a rough ride, bonds, unlisted assets and exposure to foreign currency for Australian investors provided some stability.

-

Cash is still not king – while cash and bank deposits provided safe steady returns, they remain very low.

The negatives which will likely constrain returns…

There are a bunch of threats which are likely to lead to bouts of volatility and constrain returns.

-

First, President Trump’s trade war with China and threats against other countries is adversely affecting business confidence and investment. Trade talks with China have resumed and both sides have a strong incentive to resolve the issue but there is a risk that they may not.

-

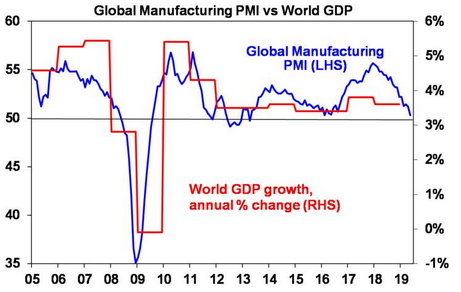

Second, global growth indicators are well down from their highs at the start of last year. And the yield curve in the US is flashing a recession warning.

Source: Bloomberg, AMP Capital

-

Third, the risk of conflict with Iran has escalated after the US ditched its commitment to the 2015 Iran nuclear agreement. As roughly 20% of global oil demand flows through the Strait of Hormuz its disruption would threaten sharply higher oil prices.

-

Fourth, US political risk is likely to ramp up with the debt ceiling needed to be increased around September (remember the debt ceiling/US ratings downgrade of 2011!) and Democratic presidential debates highlighting a sharp leftward lurch at a time when the top Democrat nominees are polling ahead of Trump.

-

Fifth, Eurozone risks remains with an increased risk of a no deal Brexit which would be a big drag on the UK economy as 46% of its exports go to the EU and a small drag on European growth as 6% of its exports go to the UK. More important for the Eurozone is the ongoing tensions around the still worsening Italian budget deficit.

-

Finally, in Australia while house prices are showing signs of being at or near the bottom, rising unemployment risks resulting in a negative feedback loop and another leg down, which in turn would further weigh on economic growth.

…but a bunch of things should keep returns positive

-

However, there are a bunch of positives providing an offset.

-

First, while global growth indicators are soft, there has been a loss of downwards momentum in the Eurozone and globally it still looks like the growth slowdowns of 2011-12 and 2015-16.

-

Second, the fall in global inflation has seen central banks move from tightening to easing to various degrees, providing a renewed stimulus to growth. This is a big difference to a year ago when it was thought that the hurdle for central bank easing was high.

-

Third, while the US yield curve is flashing red it’s not always reliable, it may be distorted by central bank quantitative easing and it has long lead times. What’s more there is still little sign of the sort of excess that normally precedes recessions – there is still spare capacity globally, growth in private debt remains moderate, investment as a share of GDP is around average or below, wages growth and inflation remain low and we are yet to see a generalised euphoria in asset prices. The current growth slowdown globally maybe seen as extending the investment cycle by delaying the build up of recession driving excesses.

-

Fourth, while Trump’s trade wars and maximum pressure on Iran may reflect the pursuit of international relevance at a time when his ability to do anything in the US is constrained (having lost Congress) it is in his interest to resolve both in a non-disruptive way as American’s don’t re-elect presidents when unemployment is rising and oil prices are surging.

-

Fifth, share valuations are not excessive. While price to earnings ratios are moderately above long-term averages in developed countries, this is to be expected in a world of low inflation. Valuation measures that allow for low interest rates and bond yields show shares to be fair value or cheap.

-

Finally, while unemployment is expected rise to 5.5% this year in Australia it should be limited as infrastructure spending remains strong, mining investment bottoms out, export demand holds up with overall growth helped by monetary and fiscal stimulus and the low Australian dollar.

What about the return outlook?

The threats around trade and geopolitical risks along with the tendency for seasonal weakness out to September/October could see a pull back in share markets and returns are likely to be constrained. But easy money and the absence of large-scale economic excess should help extend the cycle and keep returns positive at around 6% over the next 12 months from a well diversified portfolio. Looking at the major asset classes:

-

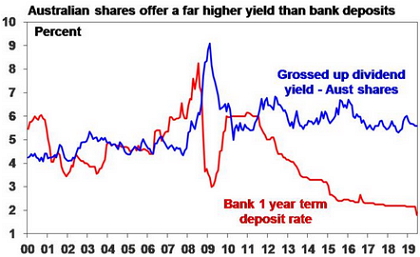

Cash and bank deposit returns are likely to be poor at around 1% as the RBA is expected to cut the cash rate to 0.5% by early next year. Investors still need to think about what they really want: if it’s capital stability then stick with cash but if it’s a decent stable income flow then consider the alternatives with Australian shares and unlisted commercial property and infrastructure still offering attractive yields.

Source: RBA; AMP Capital

-

Sovereign bond investors benefit from falling yields but once they stop falling expect returns to slow again as yields are now very low. Bonds are good portfolio diversifiers though.

-

Listed and unlisted commercial property and infrastructure are likely to benefit from the ongoing “search for yield” and okay economic growth.

-

Residential property still has a bit more short-term downside risk but expect flattish prices through calendar 2020 as an upwards drift in unemployment constrains returns.

-

Shares are at risk of a correction into the seasonally weak September/October period, but okay valuations, reasonable economic growth and profits and even easier monetary conditions should see the broad trend in shares remain up.

-

Finally, the $A is likely to fall to around $US0.65 by year end as the RBA eases, but with significant short positions, the Fed easing too and the sharp 39% $A fall already seen since 2011 it has become a closer call.

Things to keep an eye on

The key things to keep an eye are: global business conditions PMIs for any deeper slowing; the trade war – this needs to be resolved soon; Middle East tensions around Iran; US political risks; risks around Chinese growth; and Australian unemployment and house prices.

Concluding comments

Returns are likely to be okay over 2019-20 as conditions are not in place for recession. But expect constrained returns – say around 6% for a diversified fund – and bouts of volatility.

Source: AMP Capital 2 July 2019

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.